1098 Tax Statements

The 1098-T statement is now available online!

- Log on to www.southern.edu/payments.

- Click Here - Steps to view / print your 1098T statement.

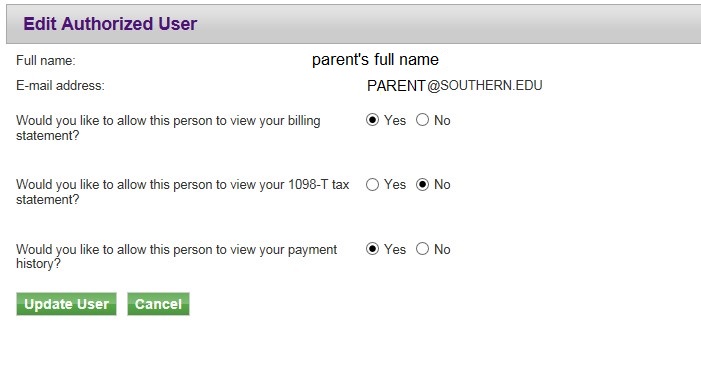

- I am a parent or authorized user and I do not see the 1098T statement even though I received a notification. Find out why and answers to other most FAQs below.

*If you desire a paper form to be mailed to you please email billing-collections@southern.edu, please include your current mailing address.

Blank statements? Viewing the 1098-T Statement requires Adobe Acrobat Reader 8.x or higher.

Each browser has its own settings to control how PDFs open from a web page. Acrobat DC and Acrobat Reader DC do not include a preference setting to open web-based PDFs. To change the display behavior, follow the instructions below for your browser, or see the browser documentation on how to control plug-ins or add-ons.

FAQS

Where do I access my 1098T form online?

What is a 1098-T Tax statement?

The 1098-T form is used by eligible educational institutions to report information about their students to the IRS as required by the Taxpayer Relief Act of 1997. Eligible educational institutions are required to submit the student's name, address, taxpayer's identification number (TIN), enrollment status, amounts pertaining to qualified tuition and related expenses, and scholarships and/or grants. A 1098-T form must also be provided to each applicable student.

Why do I receive a 1098-T?

What is the American Opportunity Tax Credit and The Lifetime Learning Credit?

Where can I find more info about the 1098-T guidelines and requirements?

Why would I not receive a 1098-T?

The amount in Box 1 is either blank or much less than was paid, can I have a corrected form?

Why is Box 2 blank?

Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, Southern Adventist University reports in Box 1 the amount of QTRE you paid during the year. This means Box 2 will always be empty.